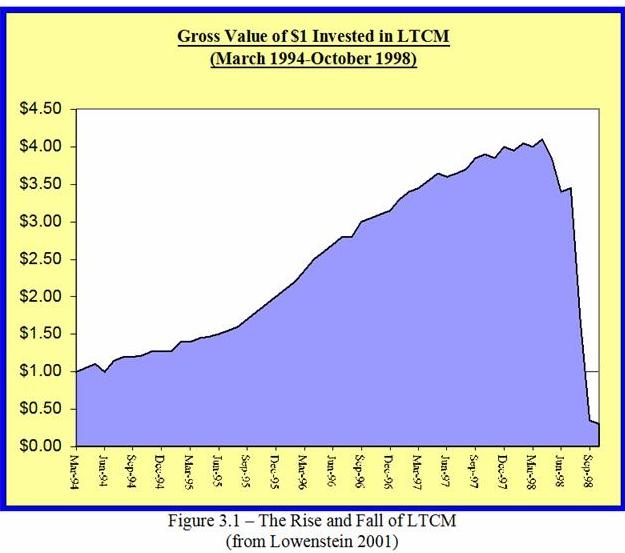

phi Mantra: LONG TERM CAPITAL MANAGEMENT (LTCM) : A debacle that every stock market analyst should understand

Difference Between Short and Long Term Capital Gains - Compare & Apply Loans & Credit Cards in India- Paisabazaar.com

Initial public offerings, bonus and rights issues will be eligible for concessional rate of 10% long-term capital gains (LTCG) tax even if the Securities Transaction Tax (STT) has not been paid earlier.

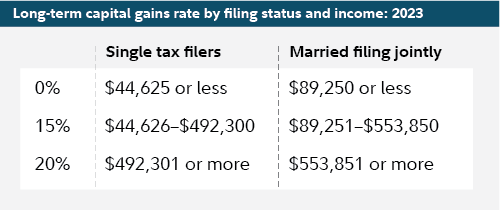

Capital Gains vs. Ordinary Income - The Differences + 3 Tax Planning Strategies - Kindness Financial Planning

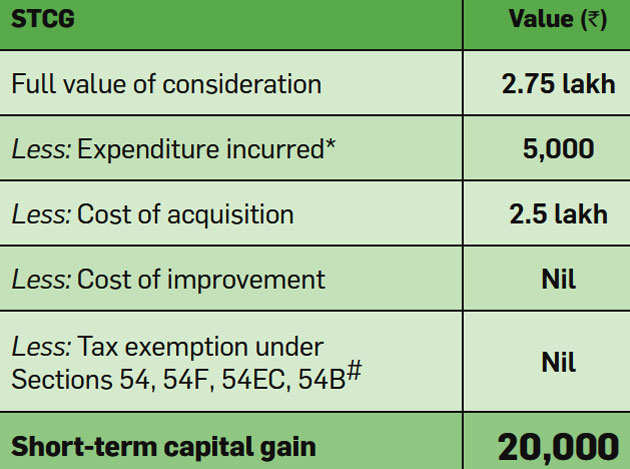

capital gain: How to calculate short-term and long-term capital gains and tax on these - The Economic Times